- This event has passed.

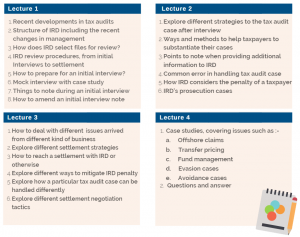

20210109_30_1 Workshop 4: A step-by-step approach to Tax Audit handling

Description

Date: 09, 16, 23 & 30 January 2021, Saturday

– Updated with IRD’s latest Tax Audit approach under new leadership

– Micro-movies illustrating case studies and IRD interview simulation

– Special tips on how to speed up case settlement in COVID-19 situation including ways to resolve offshore cases

With the Government’s budget deficit and the Inland Revenue Department’s (“IRD”) new leadership, it is expected that the IRD will step up its scrutiny on taxpayers and strengthen its measures in conducting tax audits. In particular, the officers’ views on offshore claims and cross-border related party transactions are tightening. The evolving environment has also impacted on the attitudes and tactics adopted by the officers when handling tax audits, particularly at the initial interviews and their willingness to settle. As such, new strategies are required when handling tax audits nowadays. Special care has to be taken to avoid making unnecessary mistakes, which will be costly to both taxpayers and practitioners. In this course, our following speakers will use case studies and a practical step-by-step approach to demonstrate different strategies and ways to handle tax audits and will take the participants through the journey from cradle to the final resolution.