- This event has passed.

20220108_29 Workshop1: A Step-by-Step Practical Approach to Tax Audit

Description

Date: 08, 15, 22 & 29 January 2022 (Saturday)

The Inland Revenue Department has always put a lot of efforts on tax audits. Recently we noticed that there are new focuses in the IRD’s tax audits, e.g.digital economy etc. In this webinar, we have invited the specialist from PwC to give us a highlight on the recent developments in tax audits. Participants will be invited to suggest topics for the speakers to quote relevant examples for elaboration during the webinar.

Webinar outline

- Micro-movies illustrating each step of a tax audit for common business types

- Step-by-step approach to demonstrate different strategies for resolving tax audits

- Tailor-made case analysis in Lecture 4 based on participants’ responses in Lectures 1 to 3

- Real life case sharing

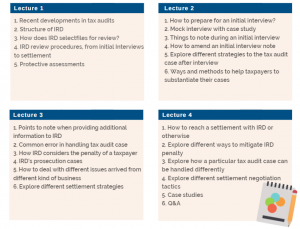

Key contents of each lecture are as follows:

Total 12 CPD hours will be granted for this workshop